–News Direct–

JustiFi, the fintech platform for platforms, today announced it raised $10 Million in a funding round co-led by existing investors Rally Ventures, Emergence Capital and Crosslink Capital and a debt facility from Silicon Valley Bank. This infusion of capital underscores JustiFi's dedication to enhancing the fintech capabilities of its expanding roster of platform customers. By seamlessly integrating payments, insurance, and Buy Now, Pay Later (BNPL) solutions into a single, user-friendly Unified Fintech Checkout, JustiFi empowers its clients to streamline their operations and unlock their full fintech potential.

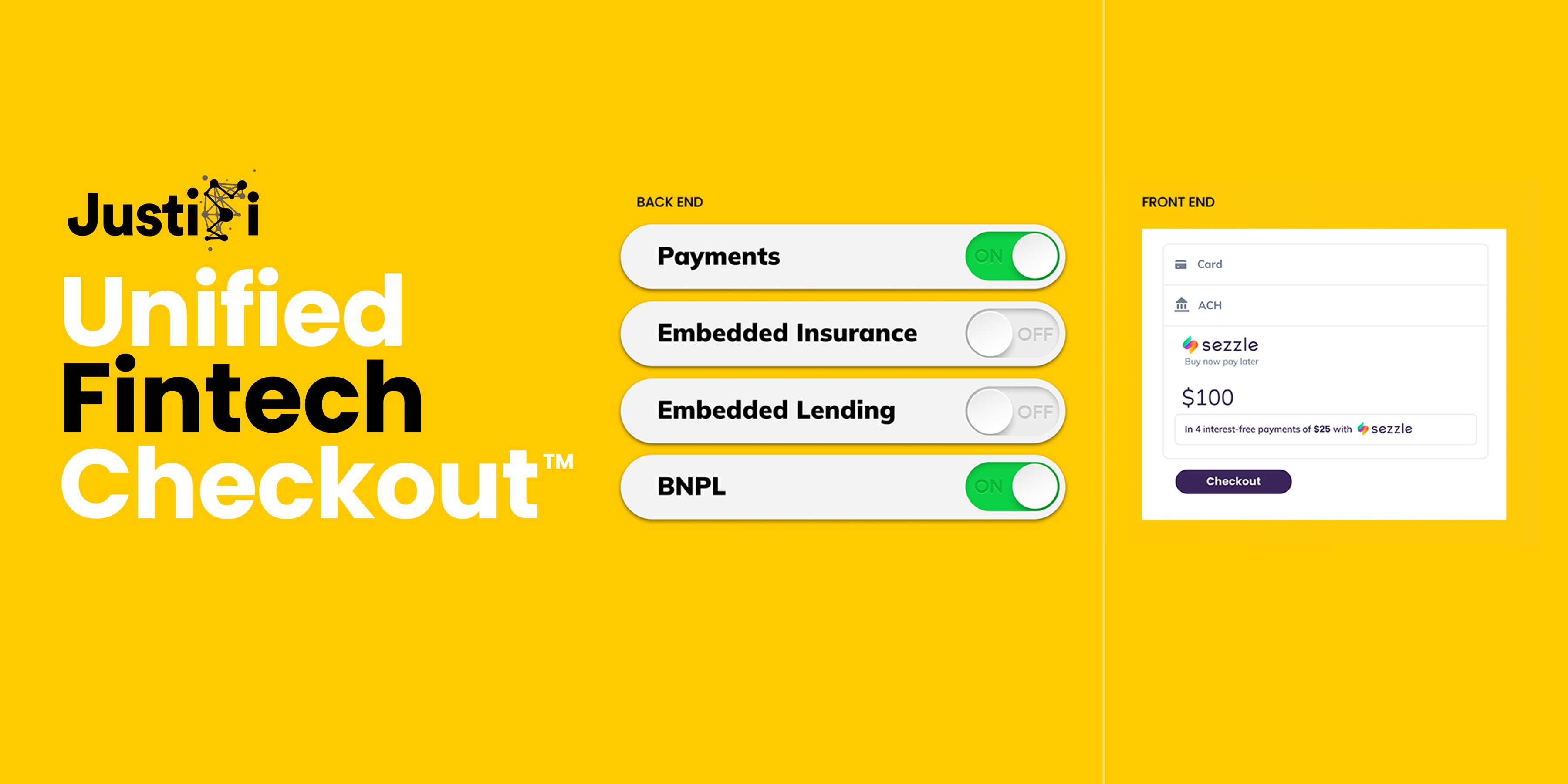

Learn more about JustiFi's latest product release: the Unified Fintech Checkout

With the Unified Fintech Checkout (UFC), platform companies gain access to a comprehensive suite of white-label fintech products ready for deployment to their existing customer base. This empowers platforms to tap into new revenue streams while offering essential fintech solutions to both their customers and the businesses they serve. The UFC's implementation is seamless, utilizing a web component that enables platforms to launch embedded payments, insurance, and BNPL in a single sprint, significantly reducing deployment time from months or even years to just a few weeks.

According to a recent Goldman Sachs report, achieving transformative fintech results hinges not only on cutting-edge technology but also on widespread adoption. While an embedded fintech infrastructure lays a solid foundation, for platforms, true success and customer satisfaction stem from comprehensive fintech integration. Recognizing this, JustiFi's Engage fintech team works closely with its platform customers to drive fintech activation from onboarding and beyond. Offering a range of services including fintech goal setting, UI and UX design, technical implementation, and go-to-market strategy, JustiFi aims for nothing short of 100% payments adoption for each and every one of their customers.

"This new investment underlines the confidence of our investors in JustiFi and our belief that vertical platforms should not only facilitate seamless financial transactions for their customers but also retain the majority of the benefits derived from them," said JustiFi Co-Founder and CEO Joe Keeley. "In a world where fintech integration is a strategic imperative for platforms, JustiFi makes it easy to seamlessly integrate payments and other valuable fintech products."

JustiFi has made huge strides since our initial investment in 2021, said Justin Kaufenberg, Managing Director at Rally Ventures. Theyve built an unparalleled fintech platform, put together a world-class team of fintech and SaaS+ veterans and onboarded over 40 platform customers who bring more than $10.6 Billion in annual processing volume. We believe JustiFi represents the future of fintech for platforms and we look forward to the journey ahead.

In other recent news, JustiFi announced the release of 11 cutting-edge web components, providing platforms with an even easier and more customizable method to embed fintech products into their existing ecosystems. Additionally, in November of 2023, JustiFi entered into a new partnership with Sezzle, enabling hundreds of platform companies to offer Buy Now, Pay Later (BNPL) services easier than ever before.

For more information about the JustiFi platform, please visit www.justifi.tech.

About JustiFi:

JustiFi, the fintech platform for platforms, enables software companies to monetize white-label fintech products like embedded payments, Buy Now, Pay Later, lending, and insurance faster than ever before. As a registered payment facilitator, JustiFi offers world-class support, assisting our platform partners in achieving 100% customer activation, while guaranteeing seamless fintech experiences for their end users.

Contact Details

Rachel Subasic

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/justifi-raises-new-capital-to-help-platforms-reach-their-fintech-potential-123105998

Rally Ventures

COMTEX_452734148/2655/2024-05-22T08:04:45

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Sahyadri Times journalist was involved in the writing and production of this article.